Why Versatile Spending Is Winning: Digital Credit in the Age of Choice

The Rise of Flexible Financial Freedom

We’re living in an era where convenience and control are no longer luxuries—they’re expectations. Whether you’re splitting lunch with friends, subscribing to a new app, or gaming online, the ability to pay quickly, safely, and on your own terms is a must. That’s where digital credit shines. Gone are the days of rigid payment systems. In their place? Versatile digital wallets, prepaid cards, and online credit that put you in the driver’s seat.

That’s exactly where flexible digital credit steps in. With prepaid solutions growing in popularity, users now have more control than ever over how and where they spend online. For instance, on Eneba – Venmo gift card is available for those who prefer to keep their banking details private while still enjoying seamless top-ups. It’s a simple, effective way to navigate platforms that might not always work well with traditional payment methods or high-fee gateways.

Why Prepaid and Digital Wallets Are Booming

The digital wallet space is booming for one simple reason: adaptability. You’re not tied to a bank or even a particular app. Want to shop online, transfer money, and still keep a firm grip on your spending habits? Prepaid cards and wallets like Venmo offer that middle ground. You load what you need—no more, no less. It’s budgeting made simple.

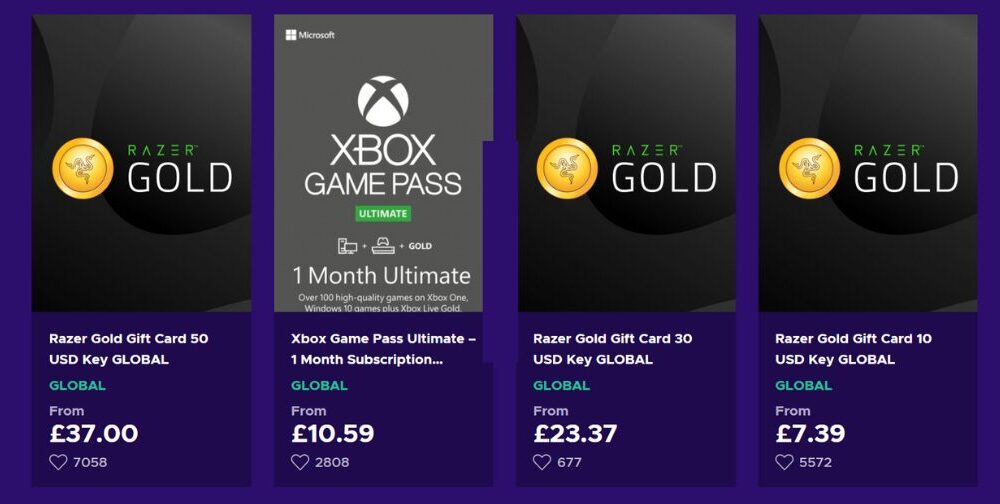

More importantly, this form of spending speaks to a modern lifestyle. Gen Z and Millennials aren’t just tech-savvy; they’re value-savvy. They want platforms and products that are fast, safe, and tailored to their needs. Digital marketplaces like Eneba are capitalizing on this shift, offering prepaid digital credit for platforms their audience already loves.

Versatility Means More Than Just Options

Let’s break it down. When we say “versatile spending,” we’re not just talking about buying power—we’re talking about personalized power.

- Gaming: Load your digital wallet and grab in-game content without sharing banking info.

- Streaming: Pay for monthly subscriptions with prepaid credit and keep it off your bank statements.

- Travel: Book services and transfers without the worry of conversion fees tied to credit cards.

This approach works because it bends to your needs. You’re not stuck using one provider, one currency, or one card. It’s all about options, and that’s what modern consumers crave.

Security, Simplicity, and Spending Smarts

Using digital credit and prepaid options also adds a layer of protection. Since you’re only loading what you intend to spend, there’s no risk of overdraft, fraud across your entire account, or credit card breaches. Add in the bonus of anonymity for certain purchases, and it’s easy to see why digital credit is becoming the go-to.

And let’s not forget the simplicity. Whether you’re topping up a gaming wallet or sending cash to a friend, it’s done in seconds. No waiting for verification emails, no routing numbers—just a seamless digital experience.

Final Swipe—Why the Future Is Prepaid

In a world that’s increasingly digital, versatile spending isn’t just a trend—it’s becoming the standard. As more platforms, games, and services shift toward flexible payment integration, digital credit is the bridge between freedom and function.

Prepaid solutions like Venmo gift cards not only offer a practical tool for daily transactions but also represent a broader shift in how people want to interact with money. No limits, no locks, just choice.

And with platforms like Eneba offering direct access to these options, digital credit isn’t just easy. It’s smart.